Marginal Costing - DEMYSTIFYING the science of “Relevant Cost” in management decision making

Table of Contents

Introduction

This article discusses that part of marginal costing called “relevant cost” and will let us into how some costs should be treated in determining the total cost of production, which costs should and shouldn’t be considered when calculating cost per unit of a product or service. I shall demonstrate the application of relevant cost using a real-life example.

What is relevant cost?

Relevant cost is defined as that cost that forms part of the production cost of a unit of output or service and that can be directly or indirectly traced to the production of the product or service. A cost is relevant, if its existence or non-existence will affect the determination of the actual cost of a product or service. Conversely, it’s also true that a cost is irrelevant if its existence or non-existence will not affect the determination of the actual cost of a product or service.

The majority of (if not all) the decisions to be made regarding relevant cost shall start with distinguishing and separating the product or service costs into MATERIAL, LABOUR, OVERHEAD and OPPORTUNITY costs. Looking closely at these various types of costs, we define them as below.

Product or service cost components

Material costs are, to put simply, the costs of the direct materials to be used up in the manufacture or production of a given product or to provide a certain service. It is also known as raw material costs or direct material costs; these interchangeable terms all describe the cost of integral materials in a product or service.

Labor cost (or total labor cost) is the total expenditure incurred by an institution or organization and paid to those who carry out the production of these products or service (called employees). Total labor cost comprises employee wages/salaries and other compensation (including benefits, reimbursables and whether paid by cash or in kind as well as employers’ social contributions for employees)

Overhead cost refers to all other ongoing costs of operating the business but excludes the labor and direct costs associated with creating/producing a product or service. Overhead costs can be fixed, variable, or a hybrid of both. An overhead cost must be attributable to the product or service in question for it to be relevant to the decision relating to the product or service.

An opportunity cost is the value of the option not taken (foregone) when a business takes a decision. For example, if the business is deciding whether to purchase two new tractors or expand its production factory, the opportunity cost here, if it eventually decides to buy the two tractors shall be the cost of not expanding its production factory which in this case would be the lost revenue. An opportunity cost could therefore be either a cost to have been saved or a revenue to have been realized that was/were missed.

The discussion of the costs above shows that in discussing relevant cost, we could be faced with the consideration of lost revenue as part of the cost consideration.

When as a manager you are faced with taking a decision,

Consider the following guides:

Evaluate the decision to be taken and ensure all costs that are incurred as a result of the business activity are relevant, regardless of the nature of the decision, consider breaking the costs into their various components.

Consider the effect of the decision on other operations of the business and take the following steps:

- If the decision will result in a reduction in cost or increase in revenue in other areas of the business, such a reduction in cost or increase in revenue must be considered as a relevant cost or relevant revenue to the decision to be taken and not to the other operations of the business.

- If the decision will result in an increase in cost or reduction in revenue in other areas of the business, such increase in cost or reduction in revenue must be considered as a relevant cost or relevant revenue to the decision to be taken and not to the other operations of the business.

- All FIXED costs are NOT relevant except they are incremental fixed costs or attributable fixed costs.

- All SUNK costs and past costs are NOT relevant: a sunk cost is that cost that was incurred in the past or committed in the past that is being carried forward to the decision at hand.

- All non-cash items such as Depreciation, Amortization and movement in Reserves are not relevant.

Now let’s look at how materials and labor costs should be treated when taking cost decisions.

Material cost

- If material required is available in the organization in large quantity but is in continuous use in the organization, the relevant cost of that material to the decision at hand is the market price of the material irrespective of the cost of the material that is in store.

- If the material required is in store, not useful to the current operations but there is a prospective buyer for the material, the relevant cost of that material to the decision at hand is the realizable value of the material required.

- If the material required is in store, not useful but can be converted to another material that is in continuous use in the business, the relevant cost of this material to the decision at hand is the market price of the material it can be converted into LESS conversion cost.

- If the material required for this decision is in the store, not useful, no prospective buyer and cannot be converted into any other material useful in the business, the relevant cost of such material to the decision at hand is ZERO.

- If the material required is in the store and is not on order (that is, has not been ordered by a customer), the relevant cost of such material to the decision at hand is the market price of the material irrespective of the cost of the material in the store.

Labor cost

- If the labor required is in the organization but currently idle, the relevant cost of such labor to the decision at hand is ZERO.

- If the labor required is in the organization but is fully engaged that would necessitate withdrawal from current work, the relevant cost of such labor is the rate of pay plus the opportunity cost of the profit or loss as a result of withdrawing such labor from its current work.

- If the labor required is available, currently idle but doing another grade of job that will now require diversion from their proper job but will necessitate replacement, the relevant cost of such labor is the rate of pay to the labor that replaced it.

- If the required labor is available but would necessitate diversion for the work under consideration but with an increased payment of wage, the relevant cost of the labor to the decision at hand is the difference in payment.

- If the required labor is not available, the relevant cost of such labor is the negotiated wages.

Note that in all consideration of product cost, the labor cost considered is the wages paid and not salaries because wages is paid to production staff as direct cost and salaries is paid to administrative staff, the only exception is where the portion of salary paid is attributable to the product cost, like when an administration manager is assigned to carry out a part of the production or to supervise the production directly, the portion of his salary that is attributable to the product production is charged to that product cost and therefore becomes a relevant cost

Practice Question

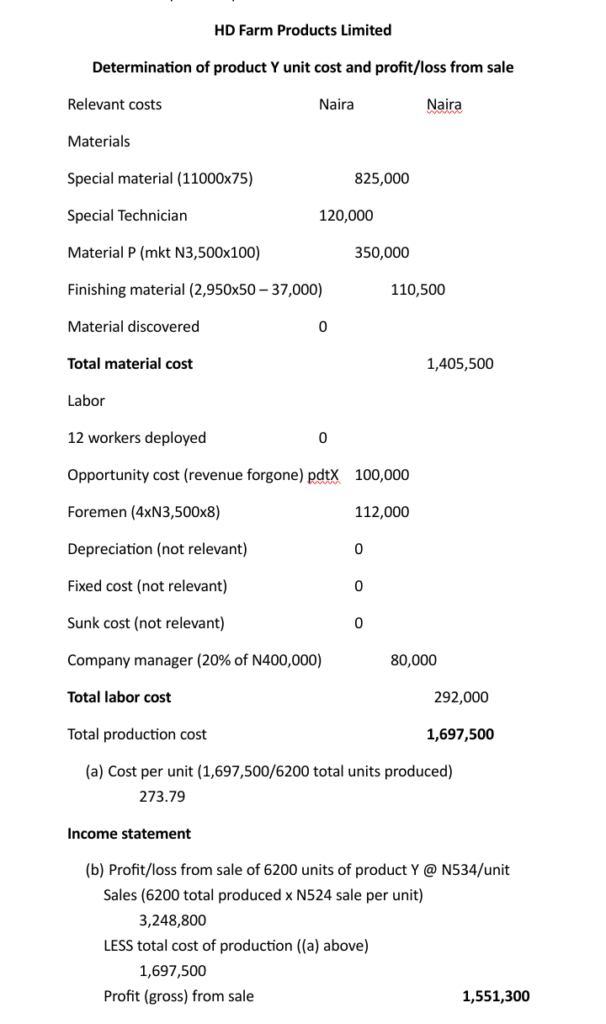

You have been hired as the management accountant of HD FARM PRODUCTS LIMITED and have been presented the following cost structure from which you are required to determine the cost per unit of Product Y and the profit or loss if the product is sold for N524 per unit.

Total production quantity of product Y is 6200 units.

Raw materials used in its production were as follows:

A special material costing N11000 per unit (75 units of this material was used) that must be used through a special machine to be operated by a special technician who charged N120,000 to put the machine to use. another material to be used (material P) were in store at the cost of N3100 per unit and have been used regularly, it’s said that the market price of these materials was N3500 per unit and 100 of these materials were used. 50 pieces of finishing material (not presently used) that’s also in store at the cost of N2700 per unit was used but this material couldn’t be used unless it is converted to usable form and to do this, this material which can be bought at N2950 per unit would need a total of N37000 to convert it to use. We discovered a set of materials (100 packets in quantity) that were brought out for the purpose of the production which though cost N2000 per unit but were not used after all.

Labor used up in this production was as follows:

There were 12 workers that were waiting for deployment so were idle at this time, they were used in this production; their wages was stated as N2080 per hour and they were recorded to have put in 6 hours of production time. Additionally, some 30 production line workers would be asked to stop the production of product X and join production of product Y, this product X yields N100,000 to the company if the workers worked to produce it, although product Y is more profitable. Also used in the production were 4 foremen who were not engaged in any activity but were available, their labor rate as per company employment letters to them was N3500 per hour and they put in a 8 hour production work time.

Other information.

- The depreciation value of the production machine was calculated to be N203,000

- The fixed company costs were estimated to be N200,000 in total amount.

- The farm had, prior to the commencement of the production of product Y, spent N370,000 on preparing the production land.

The company manager spent 20% of his time visibly being in the production area, issuing out production instructions and ensuring that production workers were prompt at work. His salary was N400000 which he earns by putting 160hours of his time.

Please check out my website www.hdeeconsultingco.com for solution to the problem.

Solution to the practice question

The significance of relevant cost from the above scenario if the principle of recognizing them wasn’t followed strictly, is portrayed by effect on the cost per unit of product Y which would have been higher and this could have under stated the gross profit and in the end may have presented the entire activity as non-profitable.

Read also, the article on LinkedIn at https://www.linkedin.com/pulse/marginal-costing-henry-eze-asszf

Insightful Tips and Expert Advice to Help You Make informed Financial Decisions.

Tax planning is a crucial aspect of running a successful business. By implementing effective tax strategies, businesses can optimize their financial . …..

As businesses strive for growth and expansion, it becomes increasingly crucial to have a solid foundation of financial transparency and accountability…..

Tax compliance is a critical aspect of running a small business. However, understanding and meeting your tax….